Struggling with finances and having no control over your expenditures? Payroll vanishing before you could bat an eye to your wallet?

Here’s a plan for a college student with limited allowance, to a full-time employee with numerous financial obligations.

This article is for all you guys who struggle with managing your money and need an ideal guide who has succeeded in mastering the solution to this struggle.

Introduction to Dave Ramsey:

People who are closely associated with the world of finances and budgeting, would not require an introduction to this famous personality.

But to briefly explain him, Dave Ramsey is an American Radio Personality who offers financial advice. At the age of 26, he was earning a quarter of a million dollars per year with a 4 million dollar real estate portfolio. Even though he filed for bankruptcy in his early years, as of 2021 his net worth was estimated to be around $200 million.

He now stands as an ideal example of turning a bad financial condition around. He rebuilt his net worth in a relatively short amount of time and now actively gives financial advice to his 13 million listeners every week over 600 radio stations.

Moving forward, we will discuss his approach and take on budgeting and finance management.

What is budgeting? How and why is it beneficial?

A famous YouTube page, that works closely with Dave Ramsey, EveryDollar defines budgeting as a plan for your money. It’s basically evaluating your revenue and expenditure for a period of time and is re-evaluated over a period to tackle and provide set funds for uncertain or urgent expenses.

As easy as it sounds, it gets pretty frustrating when you have to stick to a given routine of money expenditure.

And why is that beneficial? Well, simply because it lets you make a plan over the requirement and allocation of your funds, how much you can spend without going broke by the end of the month. Which ship will sail your money and what shall sink? And with the growing economy and insane amount of money inflation, it is necessary to keep track of your finances.

Budgeting in general is very individualistic and what plans may work for one person may not work for the other due to different commitments and different demands based on their lifestyle. Hence if you are working as a full-time employee and you want to manage your money well, it is absolutely important to consult a financial consultant or better yet a good chartered accountant.

Next up we shall discuss Dave Ramsey’s simple 7 baby steps to take control over your money.

7 Baby Steps:

Why does Dave Ramsey call them baby steps? Because he believes that right up in one go budgeting can be done, but sticking to that budget plan is tough. The temptation to buy everything you see is so evidently powerful that you give in to it and regret it later.

Baby steps basically define the starting point of your money management journey and your consistency and dedication to follow a plan is what will lay a foundation for your future financial stability.

We shall now discuss the 7 steps in detail-

- Save $1000 as your starter emergency fund:

The future is forever a variable factor and nobody has control over what may come and when it may strike. Therefore it is absolutely necessary to keep a good amount of money as emergency funds in order to ensure you can back yourself and your family up in case of sudden downfall or just to provide enough for future disparities.

- Pay off all debts using the snowball method:

List out your priorities. Exclude mortgage or any housing debt. List out everything that you need to immediately pay off. And allocate funds accordingly. Put them in an order of least payable amount to the largest regardless of the interest rate attached to it. After paying the minimum amount for everything, finish the smallest debt and then move forward to the second smallest debt.

It’s basically like targeting to clear the smallest debt but at the same time, you are slowly clearing out the bigger debts too by paying the minimum amount required that needs to be paid quarterly/monthly.

- Save 3-6 months of expenses for a fully funded emergency reserve:

All that money you blew on your debts is now lying around and the best solution for that money is to store it away as emergency funds. I mean, you never know what might happen and just how much needs to be spent on to deal with it. (You just cleared your debts, why would you want to dig another hole after closing one?)

- Invest 15% of your household income on retirement:

You’re obviously not going to be working till your last breath, and if an old age home doesn’t fancy your liking, then save some funds for your retirement plans. Save 15% of your gross income towards retirement and slowly over the years, you’ll have a good amount of money as a reserve. So if you are still working post-60, it’s basically because you want to work and not because you have to.

- Save for your child’s future education:

It takes a long time before your child will realise the importance and value of being independent therefore, until then you will need to save up funds for their future education. (You never know how their minds switch up and suddenly, they aspire to study in one of the most prestigious universities)

- Time to pay off that housing debt or mortgage:

After providing and reserving everything required, and paying off all the small and big debts, now it’s time to tackle the shark in the sea. Your housing debt or mortgage. Pay off your mortgage early, save up for it, and finish it off. That way you are absolutely free of any debts or *stress*.

- Build your wealth, and give it back:

Now that everything has been taken care of, it’s time to build your wealth, putting together everything you earn. You now have no obligations or restrictions over your expenditure (but do learn to put a restriction on yourself. Be generous enough to give it back to society in the form of charity or donations etc. while leaving inheritance for your children.

Now that’s how an absolutely wise person will deal with his money. How long will all this take? Now that depends entirely on your willingness and dedication to save (and on your income). You may ask whether these tips will definitely work. I mean. Are you willing to start this approach? Start the process and learn on your own. Or rely entirely on reckless decisions and immediate expenditure.

How to Make a Budget Plan?

En route to managing your finances on your own, a very obvious question is how? How to make a budget plan? What to consider and what to not consider.

For a more practical reference, A famous YouTube account NerdWallet gives an easy and simplified method to create a budget plan.

Here are some tips to make your budgeting process easier.

- List out your income:

According to Dave Ramsey, your first step must be to list out your income, all forms of income, basically anything you earn throughout the month. Mind you, we’re dealing with the net income, which basically means the amount you have in hand after the deduction of taxes.

Unstable or irregular money flow calls for a solution. Compare your previous months’ income and pick the lowest amount to form a budget plan out of, that way if you earn anything excess, you can save it up for the next month.

- List your expenses:

Now that you know your incoming money flow, time to determine where you need to spend it. Now before you determine that, keep in mind you need to keep some money aside for your emergency funds.

Segregate the expenses based on priorities. What needs to be paid first, what can wait, and the minimum amount you need to pay to all your debts? The amount required for the month’s food, utilities, transportation, and rent bills. Once that has been sorted out, you’ll have a clear idea of how much you can keep to yourself for miscellaneous expenses.

- Subtract all your expenses from your net income:

After subtracting all your expenses from your income, if it sums up to zero, it is called zero-based budgeting, (make sure you don’t really rely on this entirely because it’s always good to keep some amount as surplus)

However, if you feel you might just spend this amount left with you mindlessly, put it towards your future money goal, or towards your next month’s budget plan. That way you can save some more money off next month’s expenditure list.

- Track your expenses for the entire month:

There’s obviously no point in making a plan and haven’t tracked it. The most difficult part of making a budget is sticking to it, monitoring it, and cutting out the costs of unnecessary expenditures. You need to have an account for everything, everywhere you spend your money, and everything you’ve saved all month long.

This is when various apps and tracking journals come into use. Keep the budget allotted for a certain category and deduct it gradually as and when you spend money from it.

- Make a new budget before the start of every month:

Now, before the month ends, you more or less have a clue about the next month’s expenses, how much you saved this month, all the extra seasonal income, and everything that you have an account for.

Even though your budget is ideally not supposed to change often, considering the fact that your previous budget was based on pure estimations and assumptions, after the month is over, you have a clear view of the same. Also, there are lots of variations every month like celebrations, festivals, anniversaries, seasonal purchases, unexpected guest visits, etc. Therefore you need a new budget every month.

How to Stick to a Budget?

The first question must be why is it important to stick to a budget plan? In short, when you have to exert control over something, you need to be in charge of it. You need to take things in your hand, and your money is one of the important assets you need to exert control over, and that’s exactly what budgeting does.

Now the next question is how to stick to a budget.

- Keeping it real and doable:

When your budget plans are realistic and something where you aren’t over-constraining your expenditure power, you can stick to a reasonable budget plan you make for yourself.

Over-constraining is just going to encourage you to break your budget and spend unnecessarily, therefore keep a note of that.

- Set up automatic payment on specific dates:

So, payment apps or banks provide an automatic payment process where a certain amount of money from your account gets deducted and gets paid towards the respective bills, that way your bills are being paid without you forgetting about it and it’s a constant expenditure so you have a track of it.

- Plan your meals:

There’s no point in saving money with too many restrictions and you starve or don’t eat enough. (I mean what are you going to do with all that money if your health keeps deteriorating, everything you saved for will just go into your hospital bills) and on the other end of the spectrum, you may overspend on your restaurant bills when it would be clearly unnecessary or definitely not worth it.

- Make plans based on the weekly expenses:

Basically, if you try swallowing an entire apple in one go, you’re going to choke on it and, worst case, be hospitalized. Similarly, plan weekly, make it be your groceries expenditure, or fuel for the week. When you break down everything into a bite-sized budget, you tend to have better control over your expenses.

- Keep a tap of all the extra expenses:

Calling celebrations, festivals, and birthdays as extra expenses may be an extreme thing, (but you definitely do spend more than usual on these days.) So keep a tab of whenever such days are upcoming and keep a different budget line for these days. So not only are you keeping a watch over your expenses, you’re also enjoying these days without any money constraints.

- Say NO to whatever isn’t immediate or important:

Learn to refuse the urge to panic buying or stress shopping. (you’re not going to wear it either way) if you find something tempting, refuse the urge to spend money on it unless it’s absolutely necessary. Or at least convince yourself to buy it later, (all that money you make by side jobs for yourself, push the urge to whenever you have enough to generously spend on yourself) until then, say NO.

- Don’t use a credit card unless you can definitely pay it off:

Keeping track of your budget plan is basically assigning the money you own, the credit card system basically means you can spend now and pay for it later, the problem here is there’s no control over such expenditure. (plus you need to pay interest and stuff, which is so unnecessary) therefore, pay off your debts and use your own money. That way you can avoid extra expenses towards the bank.

(It’s a different argument if you can definitely pay it off.)

Budgeting Myths that you convince yourself is true:

Anything to do with maths, numbers, and keeping track of your expenses is usually assumed to be difficult and something you, for a fact know will forget. Here are some myths about budgeting (or rather excuses) you will definitely give yourself while budgeting and the reality of it.

- “Budgeting is hard.”

Not really. Budgeting has more to do with allotting your money for various things. If you do not have control over your money you are bound to go broke soon.

- “I do not have the time to budget.”

Well, if you want to be financially stable, and know where all your money is going, and if you do not want to desperately wait for your next paycheck, you need to budget your finances. (If you could make some time to scroll through your social media, I am sure you have time to make a budget plan and stick to it)

- “I can’t do maths.”

It’s basically maths. Plus it’s YOUR money. Why would you want to neglect your own money?

- “I can do budgeting in my head”

Yeah well if you could you wouldn’t struggle with your money or managing your finances. If it’s clearly not working for you, why would you want to rely on that method?

- “I can budget by keeping track of everywhere I spend”

Well, what about your future savings? And what about your money goals? If you have control over your expenses, how would you be sure of how much you are saving and where you can potentially invest in future goals or what you want to spend on in the future?

- “Budgeting is basically restricting.”

Well, that’s one of the biggest reasons to set a budget plan that is not too constraining and restrictive, in order to give you the freedom to spend as well as save efficiently.

- “I make a good amount of money, I don’t need a budget plan.”

Well, money isn’t yours. It’s just your turn to spend it. It comes and it goes. And if you do not have control over expenses within no time you may have nothing in hand.

- “I have job security.”

Well, you never know! Situations do change, time is never constant, and two days cannot be the exact same. Hence never rely entirely on your job or your salary. It is important to save adequately enough especially if you have a family to take care of.

- “I cannot be accountable all the time/I cannot always keep track of everything.”

You mean you’re lazy and cannot take care of your money? It sure can be tiring to update your budget plan every day, how about this, once in two days? But until then you need to remember where you spent every penny and you need to remember all the expenses accurately.

- “I am debt-free, so I have nothing to save for.”

Do not underestimate future emergencies. You never know when something might strike and you might immediately need money for it. Being debt-free is good, but being casual about future needs is a big risk.

Tips to Save Money:

Here are some quick and easy tips to save money in little ways that can definitely make a good impact on your unnecessary expenses:

- Cut down on your groceries. But only what is required and used regularly.

- Remove your cable connection; switch to streaming services and subscribe to only what you will watch.

- Do it yourself! Simple projects like painting a room or small tasks like fixing the table etc, instead of hiring a person, do it yourself. (plus it may serve as a good fun time activity to do with your family)

- Buy generic products. (the branded ones are nice, but you don’t NEED them)

- Reduce unnecessary bills. (listen to your mother and switch off the AC when it is not required)

- Pack lunch, eat at home. (There is food at home. Do not keep it for tomorrow and then throw it away.)

- Shop when there are discounts and do not use a credit card.

- Do not spend on anything unnecessary for a good one month. ( basically, buy only what you need for a month straight and not everything you want)

- Use cash-back apps and coupons.

- Sell stuff to second-hand retailers. ( and buy second-hand stuff, if it’s not in a really bad condition)

Alternative Budget plans:

50/30/20 Budget plan:

So, the basic plan is 50% of your income goes to your needs, that’s groceries, food, fuel, and shelter rents, 30% goes to your wants, all the expenditure you direct towards yourself and your loved ones, and 20% goes into your savings for the future. This plan however doesn’t really help you with clearing debts. This is more of a plan to save money as well as spend enough at the same time.

60% Solution:

This basically combines all your wants and needs into the 60% category and saves the rest 40% of your income. But, the 40% goes into your retirement plans, future emergency savings, savings for your child’s future education, etc. when you think of it, it’s a very small amount allocated to too many important categories. Hence does not really help much.

Reverse Budgeting:

It’s basically when you think of how much to save first and then think of how much to spend. But it makes it difficult to tackle the load of debts and to allocate enough funds towards your daily expenses, which in turn makes the budget restrictive and then you might not follow it anymore because you cannot spend enough. And that defies the whole reason to make and follow a budget plan.

Zero-based budgeting:

Basically, when your income and expenses after being deducted amount to zero, it get nullified. Whatever you earn goes perfectly into your savings, expenses, and payments towards debts after deducting everything. It amounts to zero.

Apps that can help you keep track of your money:

- EveryDollar: Now this app belongs to Dave Ramsey, and needless to say it obviously would help you extensively to manage your money.

- YNAB (You Need A Budget): Basically tracks your expenses and gives you a clear view on what all you’ve spent, how much you’ve saved etc.

- Mint: basically is absolutely free and one of the best budgeting apps available.

- NerdWallet: This does a good job of tracking your expenses and finances and also helps you keep a tap of how much you saved.

FAQs

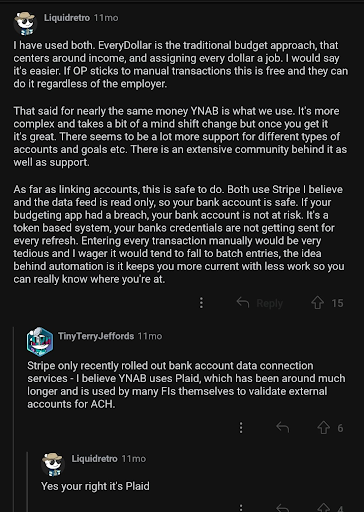

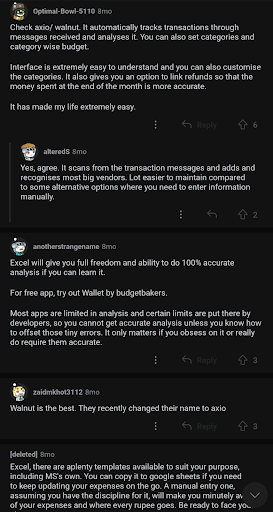

- Is the Jupiter banking app useful?

Well, we have some real-time reviews of the app users mentioned here so you can refer to this and make a choice. You can also read the app reviews from the Google Play Store.

- Can I budget without any apps?

Yes, use an Excel sheet.

- Do I need to budget every month?

Yes, your expenses vary monthly unless it’s something constant like rent. Electricity bills etc. so you need a new budget plan every month.